The End of Banking? Wealthsimple is betting on it.

At its inaugural Wealthsimple Presents, Wealthsimple launched bold new products, built to match the realities of how Canadians spend, save, and borrow.

June 11, 2025

Toronto, ON (June 11, 2025) — Today at Wealthsimple Presents: The End of Banking?, Wealthsimple launched its first credit card, instant line of credit, and major expansions to the Wealthsimple chequing account.

These new offerings reflect Wealthsimple’s commitment to building a full-service financial solution that provides Canadians with on-demand access to financial services, without the traditional fees or the need to visit a bank branch.

According to an Angus Reid study commissioned by Wealthsimple, over 1 in 3 (38%) Canadians have considered leaving their big bank in the past year and a quarter (25%) say they’re dissatisfied with the current banking system.

The top reasons? Hidden fees (47%), poor customer service (37%), better offers elsewhere (36%), and loss of trust (30%). These findings highlight an alarming gap between Canadians’ evolving expectations and what big banks offer, and that needs to change.

“Canadians don’t need another bank. They need something better. That’s what we’re building at Wealthsimple,” says Michael Katchen, Co-founder and CEO at Wealthsimple. “We’re removing the friction, fees, and outdated experiences that have defined traditional banking and replacing them with products that reflect how Canadians deserve to live, spend, and save.”

More than 100,000 Canadians registered for the Wealthsimple Presents product livestream, with hundreds of clients attending in person at Evergreen Brickworks to hear about the company’s latest innovations. During the event, Senior Director of Product, Sam Newman-Bremang and VP of Product Design, Polly D’Arcy, announced a series of new products and services:

Wealthsimple credit card: Unlimited 2% cash back, no monthly fees

Wealthsimple released its first credit card – the most requested product in the company’s history – empowering Canadians to spend confidently and stay in control of their finances. Highlights include:

- 2% unlimited cash back on everything. No categories, no caps, no games.

- No annual fee for Wealthsimple Premium clients ($100,000 or more at Wealthsimple) or clients who have a monthly direct deposit of $4,000. For all other clients, there’s a monthly fee of $10.

- No surprise FX fees. While most other credit cards charge up to 2.5% on top of the exchange rate, the Wealthsimple credit card has no added exchange fees when travelling or spending globally.

“This isn’t just another credit card, it’s the one Canadians have been asking for,” says Sam Newman-Bremang, Senior Product Director at Wealthsimple. “As the most requested product in our history, it’s clear people want a smarter and more rewarding way to use credit. So that’s what we built: a card that puts humans first, with unlimited cashback, no foreign transaction fees, and no hidden charges.”

Wealthsimple instant line of credit: Borrow with flexibility

Set to arrive by end of year, Wealthsimple’s new instant line of credit is designed to make borrowing simple, affordable, and flexible.

- Asset-backed access. Clients can leverage eligible Wealthsimple account balances as collateral. The more a client holds across these accounts, the more they can borrow.

- Low interest. Wealthsimple’s line of credit rate starts as low as 4.45%. Most credit cards, which are unsecured, charge between 20% to 24%, and home equity lines of credit, which are secured against the value of a home, require significant paperwork and homeownership to qualify. They typically range from 5.5% to 5.7%.

- Quick access. Clients can apply through the app and pending approval, access funds in a few taps. No branch visits required.

Wealthsimple chequing: A smarter way to spend and save

Over 1 in 3 Canadians (38%) have paid hidden or unexpected banking fees in the past year, fees that big banks continue to raise.

Wealthsimple, however, is committed to eliminating those costs by building a chequing account that rewards clients, rather than charging them to use it. In the last year, Wealthsimple clients have saved more than $100 million by not paying a monthly account fee.

- Earn up to 2.75% interest. The highest interest rate for a chequing account in Canada, with 1% cashback on everything, every time a client spends.

- Direct deposit benefits. When clients direct deposit with Wealthsimple, they can access their pay up to a day early based on expedited settlement. And for qualifying direct deposits clients can get a 0.5% interest boost on their entire chequing and savings account balance.

- Free ATM withdrawals. Anywhere in Canada, with fee reimbursements up to $5 per withdrawal.

- No FX fees. No surprise or added foreign exchange fees when a client spends internationally.

- Automated investing & savings. Clients can instantly invest or transfer a portion of their pay to their savings.

- Saving with peace of mind. Up to $1M in CDIC coverage on eligible deposits, new ‘trusted contacts’ for fraud prevention, custom transaction limits and more.

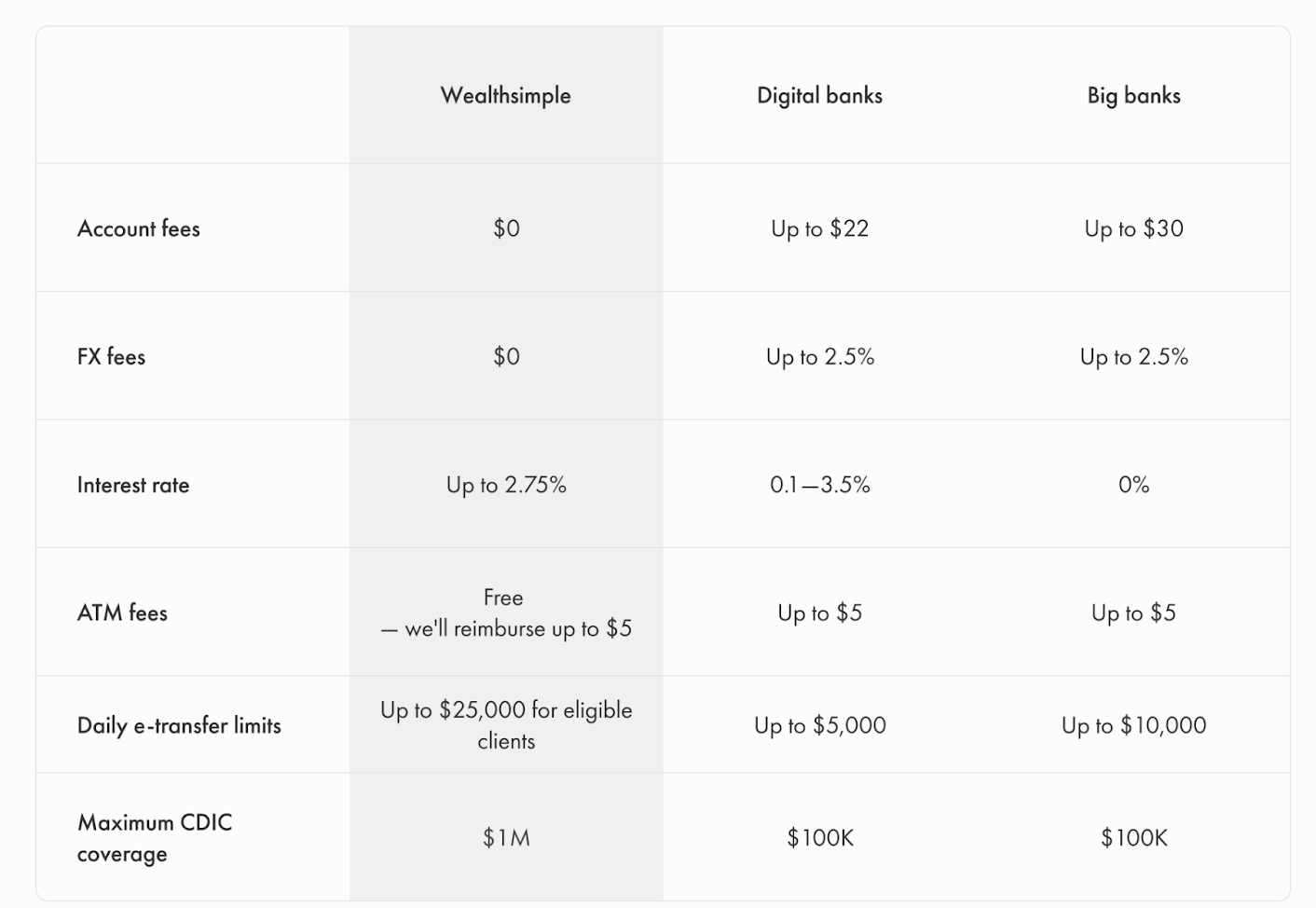

How Wealthsimple measures up

Until now, everyday banking meant standing in line, booking appointments at branches, or being put on hold over the phone. In fact, 1 in 5 Canadians (20%) have spent two or more hours managing banking issues that should have been solved in minutes with better tools.

Wealthsimple is changing that, redefining banking by bringing branch services directly to Canadians, offering instant, on-demand access anytime, anywhere with 24/7 support.

- Bank drafts. Shipped directly to a recipient the next day with no delivery costs.

- Domestic wire transfers. No added costs to receive and low cost to send, while many traditional banks charge from $35 and up for domestic outgoing wires.

- International money transfers. Low FX rates and fees, powered by Wise.

As nearly 1 in 4 Canadians (28%) see a future without physical bank branches, Wealthsimple is building toward that future today. The company will continue to expand its app with new, industry-first features designed to put control back where it belongs: in the hands of Canadians.

- Cheque delivery. Write and send cheques from the app, delivered right to the recipient’s door.

- Cash delivery. Real cash, delivered right to a client’s doorstep.

Availability

The Wealthsimple credit card and new features for Wealthsimple chequing are now available, with plans to roll out the line of credit by the end of 2025. Cash delivery will be piloted in the Greater Toronto Area this fall, with more cities to follow.

.png)

About Wealthsimple

Wealthsimple is one of Canada’s fastest growing and most trusted money management platforms. The company offers a full suite of simple, sophisticated financial products across managed investing, do-it-yourself trading, cryptocurrency, tax filing, spending and saving. Wealthsimple currently serves 3 million Canadians and holds over $70 billion in assets. The company was founded in 2014 by a team of financial experts and technology entrepreneurs, and is headquartered in Toronto, Canada. To learn more, visit www.wealthsimple.com.

Methodology

These findings are from a survey conducted by Wealthsimple from May 23rd to May 26th, 2025, among a representative sample of 1500 online Canadians who are members of the Angus Reid Forum. The survey was conducted in English and French. For comparison purposes only, a probability sample of this size would carry a margin of error of +/-2.53 percentage points, 19 times out of 20.