This is what higher expectations look like

A message from our CEO

December 22, 2025

Dear clients,

As the year comes to a close, I’ve been reflecting on the extraordinary people across Canada who are working hard to lift this country up.

It’s why I came home after a few years in Silicon Valley. I knew I wanted to build a company that would help people. And I knew I wanted to do that here.

I believed, then and now, that by making financial tools simpler and more accessible, we could help Canadians build lasting financial freedom for generations to come — and contribute to a stronger, more prosperous Canada.

I’m grateful to the millions of you who trust us with your life savings. Our success is rooted in earning your trust: by helping you control the things you can, like costs, and prepare for the things you can’t, like changes in the direction of the economy. We believe we have a responsibility to advocate for the things that will help you build a better financial future. When you prosper, so do we.

It’s been a remarkable year for many of you. I’m more optimistic than ever about the path we’re on. Which is why I wanted to take a few minutes to celebrate what we’ve achieved together, and tell you how we plan to supercharge that momentum in 2026.

IMPACT

Here’s what you achieved this year:

- $10 billion: the wealth you’ve built for yourself and your families by investing in the markets.

- $200 million: the interest you earned in 2025 by using our high-interest, no-fee chequing account.1

- $1.3 billion: the estimated fees you’ve saved by choosing commission-free trading.2

- 500 million: total minutes you spent reading TLDR in 2025 and learning about markets and money.

PRODUCTS

Your feedback is a huge contributor to how we decide what to build and where to iterate when things don’t meet your expectations. This year we took some of the biggest steps in our history toward serving you more completely and launched the most products we ever have in a calendar year, many in direct response to your feedback:

- We added features like bank draft delivery, mobile cheque deposit, USD savings accounts and international money transfers so you could finally use Wealthsimple as your main financial partner. In response, we’re seeing more of you break up with your bank and direct deposit your paycheque to Wealthsimple. Getting paid up to 24 hours early is nice, too.

- Having more sophisticated trading tools to level up your portfolios was important to many of you. This year we launched margin accounts, expanded options strategies, 24/5 trading, and more. And we added self-directed RESPs for parents who like do-it-yourself investing.

- A credit card was the No. 1 product request in the history of Wealthsimple. In 2025 we built one. By the end of the year, 100,000 of you will have been invited to use the Wealthsimple credit card. We’re excited to get it to even more of you in 2026.

PERFORMANCE

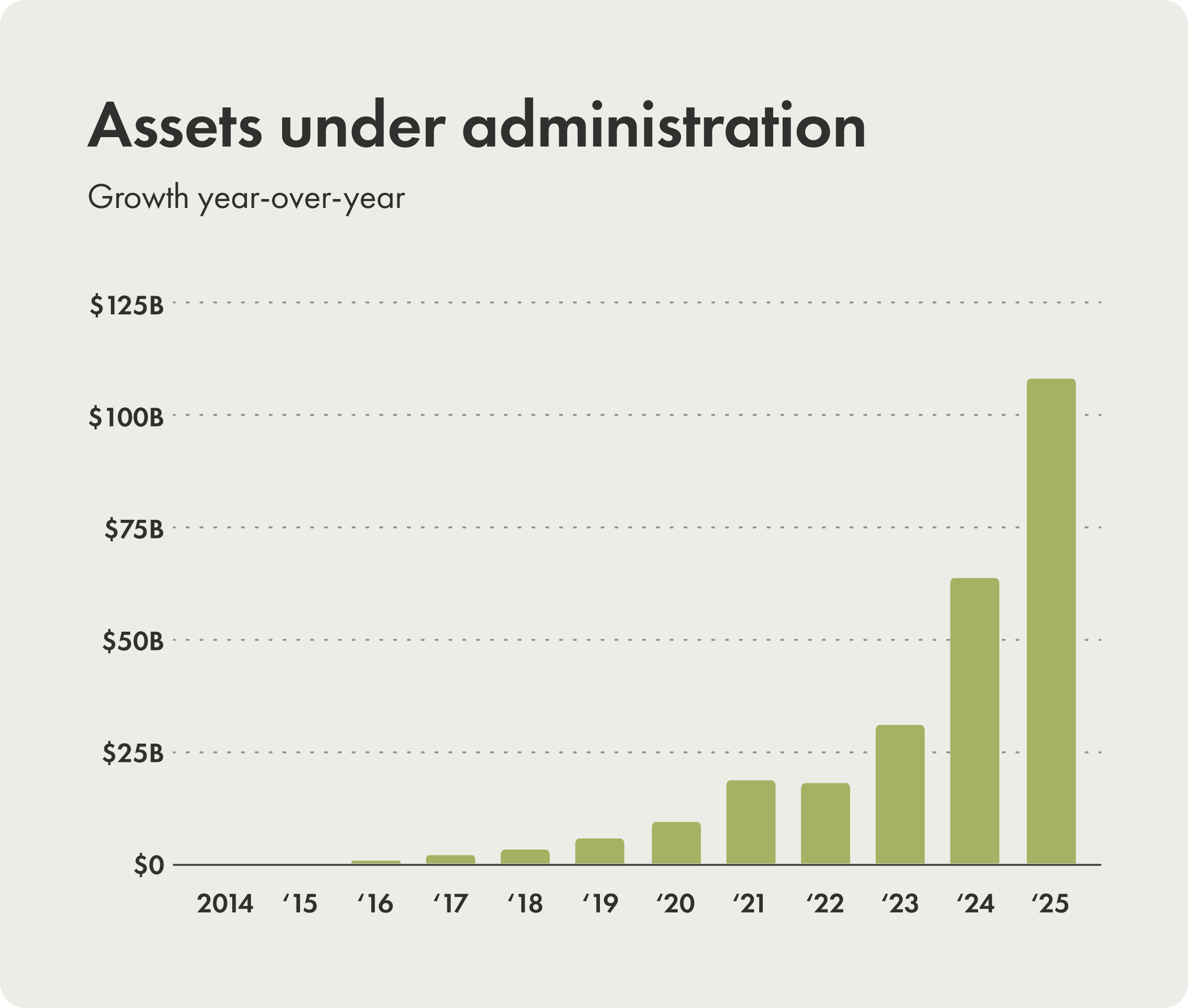

One of the ways we measure trust is through assets under administration. Below is a chart I reference often. In the last year, the assets you trust us with have doubled from $50 billion to over $100 billion. Many of you are bringing your entire financial life to Wealthsimple. And you’re referring the people who trust you the most: friends and family. It’s the No. 1 way people come to Wealthsimple. This year, we welcomed more than 650,000 new clients.

THE ROAD AHEAD

The business is growing and we continue to be profitable. We recently announced a $750 million equity round that will allow us to continue scaling from a position of strength.

In 2026 we plan to expand our spending and investing services further. We’ll scale financial advice through both humans and AI. We’ll bring investment opportunities once reserved for the wealthy to many more Canadians. And we’ll continue to influence change with innovative products designed for you. You can expect a lot from us. We want you to. That’s how we win — together.

The new year will also include the return of our product showcase, Wealthsimple Presents (maybe even to a new city). One of the real highlights for me from those events is having the opportunity to chat with many of you in person. One story in particular stood out. A client started investing with Wealthsimple about 10 years ago. At the time he and his parents were living in his two-bedroom rental. He had come to Canada for school, and his parents joined him a few years later. They wanted to grow roots here in Canada. After a few years of disciplined investing, he was able to buy his first home. He encouraged his parents to start investing, and now they’re in the market to buy too. He and his family found financial stability and independence. And now he’s planning to go back to school for his MBA because he wants to build his own business here.

It’s a sentiment I hear often from our clients: joining Wealthsimple isn’t just about managing your finances. It’s about raising expectations and aspiring to more. Something different. It’s about believing Canadians deserve the best.

Thank you for deeply believing in what we’re building. Thank you for your trust, your ideas, and your commitment to building a better financial future for yourself and for Canada. It’s the greatest privilege of our work.

Here’s to aspiring to more. And an ambitious year ahead.

Keep it simple.

Michael Katchen

CEO and co-founder, Wealthsimple

1Total Interest earnt by clients is based on internal data for the whole of 2025, excluding December, which isn’t paid out to Clients until January 2026. Current Interest rate ranges from 1.25% to 2.25% and is dependent on total assets with Wealthsimple. Annualized rate, calculated daily, paid monthly. Subject to change. See wsim.co/rates for details.

2Estimated savings of Wealthsimple Self-directed Investing clients who have traded on our platform in 2025, compared to the maximum fee they would have been charged if they had placed their trades elsewhere. Maximum fee amount shown as at October 1, 2025 from the leading five Banks in Canada, ranging from $0 - $9.99 for commission fees, on stocks, ETFs and options only, $1.25 options contract fee, and the average margin interest rate of 6.0%. For illustrative purposes only. Actual fees may vary. All investments involve risk. See wsim.co/fee-schedule and wsim.co/pricing for details.

Interac e-Transfer® is a registered trade-mark of Interac Corp. Used under license.