Our submission to the 2025 Federal Pre-budget Consultation

Shared with the House of Commons Standing Committee on Finance

August 12, 2025

August 2025

Recommendations

1. The Financial Consumer Agency of Canada (FCAC) should review the rights it prescribed to Canadians transferring registered plans between banks and audit compliance with the Voluntary Commitments and Codes of Conduct Guidelines for Transfers of Registered Plans. If FCAC determines the current standard lacking adequate protection over Canadians’ savings, it should propose amendments to strengthen them. The government should also endeavour to harmonize this standard with provincial and territorial regulators so that all Canadians have the same protection for their registered plans.

2. The budget should keep hundreds of millions of dollars in the pockets of Canadians saving for their futures by amending the Income Tax Act and related regulations to contain spiralling and exploitative exit and transfer fees on registered accounts. This consumer protection standard could be administered and enforced by the FCAC in collaboration with provincial and territorial regulators.

Introduction

In the last election all political parties prioritized reducing costs for Canadians. Registered accounts like RRSPs, TFSAs, RESPs and FHSAs are critical tools that help Canadians save for their first home, retirement, or their children’s education. Rising exit fees and avoidable transfer delays undermine these tools and threaten Canadians’ ability to make cost-effective, long-term financial decisions.

Despite an existing commitment to complete transfers within 7 to 12 business days, Canadians often experience delays of weeks or months.

At the same time, exit fees have risen from $0–$75 in the early 2010s to near-ubiquitous $150 per account in 2025 — costing Canadians hundreds of millions of dollars annually and borne disproportionately by Gen Z and millennials.

Wealthsimple serves over three million Canadians with investment, savings, tax, and payment products. One in five Canadians aged 18-40 is a Wealthsimple client.

Younger Canadians face a unique set of economic pressures: an affordability crisis, delayed home ownership, and global volatility. Trust in large institutions is weakening — governments must earn it back with consistent, visible action.

On exit fees, we lead by example: we do not charge a customer who wishes to leave Wealthsimple or close an account. Canadians — regardless of net worth — should be free to exercise control over their savings without penalty.

Over the last decade, we have participated in numerous consultations. Our consistent position: Canada cannot achieve a fair and efficient financial system without closing the competition gap.

Today, we reiterate our support for measures that lower costs for consumers and offer recommendations based on experience and client feedback.

Background: The rising importance, complexity, and volume of registered plans

With declining workplace pension coverage and delayed homeownership, individuals must take greater responsibility for their long-term financial security. Registered savings and investment accounts have helped, including RESP expansion (1998), RDSP (2008), TFSA (2009) and FHSA (2023). Canadians value these accounts and they must be safeguarded from exploitation.

The number of registered accounts is growing quickly: between 2012 and 2022 the number of TFSAs grew from 12 to 28 million, more than a million FHSAs have been opened, add RRSPs and other registered plans, >40 million accounts is a reasonable estimate.

Transferring registered accounts is difficult and costly. Canada’s fragmented oversight regime, one that allows registered accounts to be offered by federally regulated banks, trust and insurance companies and provincially regulated investment dealers, credit unions and pension plans creates unique challenges for regulators to address these problems. The solution is to harmonize standards at the plan-level via changes to the Income Tax Act and associated regulations. It is the best way to guarantee uniform consumer protection and build a more cohesive Canadian economy.

The Problem

(i) Delays

“In a volatile financial world, account transfers can leave your investments in limbo for weeks and even months. Some in the industry say transfers lately have been slower than ever…There’s no incentive to rush a job that puts investment assets in the hands of another company.” Rob Carrick, The Globe and Mail, October 14 2022

Between Q4 2024 and Q1 2025 Wealthsimple processed several hundred thousand inbound transfers of registered plans. 45% of these were executed manually by the originating institution — specifically, by fax and mailed cheques.

During this six-month period:

- The average transfer after the sending institution received all necessary documentation took 19 days.

- More than 13,000 registered account transfers took >45 days.

- Wealthsimple clients average $1B in transit funds (peaking at $2B in March).

- 15% of transfer requests were cancelled by clients due to delays.

- Fees levied on transfers to Wealthsimple alone was in excess of $35M.

Delays benefit the financial institution at the clients’ expense. During a manual transfer, clients’ capital is removed from their account and placed on the sending institution’s balance sheet — available to be deployed for profit as a loan or to meet liquidity requirements without any corresponding benefit to the client.

Between October 2024 and March 2025 Wealthsimple clients provided $1B+ in interest-free loans from their registered plans to some of the largest and most profitable institutions in the world — and paid $35 million for the privilege.

Slow transfers are not new:

In June 2021 the MFDA published the results of its public consultation on transfers. “Once a client has decided to transfer their account, it is reasonable to expect that delivering institutions act diligently and promptly in order to facilitate the transfer in a timely manner…We believe that [mandating] transfer timelines and the use of an automated platform that increases transparency of the process could mitigate delays arising from delivering institutions endeavoring to retain clients.”

In May 2023 CIRO validated the primacy of this issue: "CIRO aims to publish proposals within the current fiscal year that will likely require firms to use automated account transfer facilities as much as possible and will also set deadlines for dealers to meet when transferring accounts."

Most recently, in July 2025 CIRO White Paper: Enhancing Timely and Efficient Account Transfers in Canada noted “Transfer complaints from investors to CIRO over the last 10 years have been consistently rising and increased more than five-fold since 2015…[Complaints] regarding the lack of accountability for delays in the transfer process were commonly noted. Investors often alleged that their advisor at the delivering institution would intentionally delay the account transfer as their advisor attempted to retain their business. Investors also alleged that the delivering institution would intentionally delay the account transfer to continue to receive any interest payable on assets held.”

(ii) Spiralling Junk Fees

“Account transfer fees are a mostly hidden but potent example of financial industry arrogance. After failing to earn your continuing loyalty, these companies charge you to make your escape.”

Rob Carrick, The Globe and Mail, May 28 2025

Despite efficiencies provided by technology (electronic transfers cost Wealthsimple less than $2 to process) exit fees have ballooned: from $0–$75 in 2015 to an average of $150+ per account today. If you accept the conservative estimate of 40 million registered plans this equates to $60 million in fees for every 1% of accounts transferred for $150.

References to reimbursement are used to distract from the regressive impact of these fees on ordinary Canadians. In reality, the majority of financial institutions limit reimbursement to accounts above $25,000 (if they offer them at all).

So who has more than $25,000 in individual registered plans? Canadians over 50.

- CRA data indicates the average TFSA balance crosses $25,000 once the plan holder reaches 50. This is consistent with Wealthsimple’s experience.

- RRSP balances are not reported but Stats Can data shows Canadians <35 contribute more to TFSAs than RRSPs so it is reasonable to assume similar age variance in balances.

- FHSAs launched in 2023 limit annual contributions at $8,000, making it unlikely many account holders could qualify for reimbursement until several years after opening.

Flat fees disproportionately impact lower balances.

Age | 18-20 | 20-24 | 25-29 | 30-34 | 35-39 | 40-44 | 45-49 | 50-54 | 55-59 | 60-64 | 65-69 | 70+ |

$3,304

| $6,558

| $10,961

| $13,822

| $15,594

| $17,604

| $21,177

| $26,479

| $33,242

| $39,756

| $45,156

| $50,000+

| |

% of $150 transfer fee | 4.5% | 2.3% | 1.4% | 1.1% | 1% | 0.89% | 0.71% | 0.57% | 0.45% | 0.38% | 0.33% | <0.3% |

Finally, reliance on reimbursements as a remedy places unnecessary burden and red tape on the consumer. In Wealthsimple’s experience, not only are younger Canadians least likely to be eligible, they are also far less likely to request them. Before transitioning to automatic reimbursements (to ease friction and toil on both sides), only 35% of clients eligible for refunds requested them — even after being prompted by email. What’s more, the strongest indicators of whether or not a client requested reimbursement they qualified for were age and assets. The older and wealthier the client, the more likely they are to request reimbursement.

In July 2025 CIRO confirmed “Complaints from investors regarding transfer fees were commonly noted. Investors either complained that the transfer fees were too high or that the transfer fees were not reimbursed by the receiving institution.”

Jurisdiction

As described in the Financial Consumer Agency (FCAC)’s Registered Products: Know Your Rights and through its obligation to monitor compliance with the Canadian Bankers Association’s Voluntary Commitments and Codes of Conduct Guidelines for Transfers of Registered Plans, the federal government already asserts its jurisdiction over the transfers of registered plans by banks. The effectiveness of this oversight is less clear.

Provincial regulators have a role to play and CIRO’s recent work to strengthen the oversight regime is promising but has faced repeated delays and inconsistent engagement from industry. Provincial regulators likely welcome federal leadership as CIRO itself highlights that more than 2 out of 3 transfers relate to registered accounts established under the Income Tax Act’s authority.

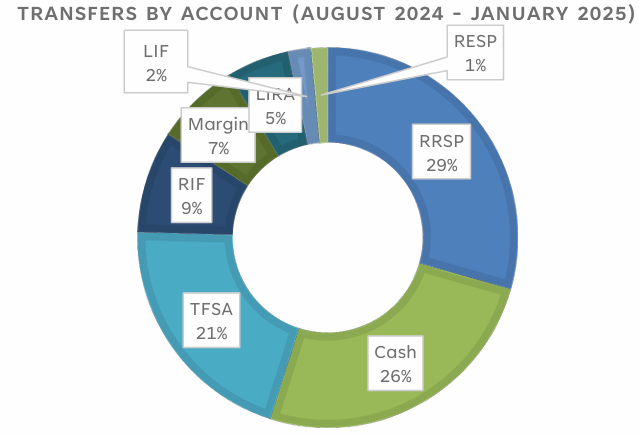

In Wealthsimple’s case, more than 90% of transfers (both in and out) are of registered plans.

Source: CIRO (2025)

The federal government should take advantage of its sole and complete jurisdiction over registered plans and its unilateral authority to impose conditions on how those accounts are administered, including restrictions on fees, no matter whether the account is offered by a federally- or provincially-regulated financial institution. It is in the federal government’s interest to ensure a consistent administration of this tax expenditure by the Department of Finance Canada and should do so with an adjustment to the Act.

Enforceable Consumer Protection in Other Highly Regulated Sectors

Telecommunications: CRTC’s Wireless Code and Internet Code bans disconnect fees and number portability is mandated, enabling Canadians to switch cell phone, cable and internet providers without penalty.

Banking: The FCAC has capped NSF fees and increased transparency around service charges.

Air Travel: The Canadian Transportation Agency’s Air Passenger Protection regulations mandates clear, upfront disclosure of fees and requires airlines to refund unused services without penalty in many circumstances, protecting consumers from hidden or punitive charges when changing or cancelling plans.

Canadians view these measures as fair, effective, and in their best interest — they have resulted in lower lower bills and better compensation, particularly for young and low- and middle-income Canadians who are less able to negotiate or push back on poor service.

Conclusion

Registered accounts are intended to empower Canadians to build financial security — for a home, retirement, education, or other priorities. Rising exit fees and systemic delays are undermining that promise.

There is no reason why financial institutions should be permitted to levy high, hidden exit fees on the rapidly growing number of registered plans nor should they be able to exploit a perceived uncertainty in federal and provincial jurisdiction where no such uncertainty exists when it comes to registered plans.

The federal government has the jurisdiction and the track record to act decisively. It has curbed telecom, airline, and banking fees. It can — and should — do the same for registered savings and investment accounts.

This issue advances the vision of One Canadian Economy and has real world value for Canadians. They want the federal government to act and so do we.