Wealthsimple’s Product Suite Delivers in 2024

December 18, 2024

Toronto, ON – December 18, 2024 – Wealthsimple celebrates a transformative year as it continues to redefine Canada’s financial landscape. Over the past year, the company has rolled out a range of new features and products, establishing itself as a sophisticated financial platform for investors across all generations and wealth levels.

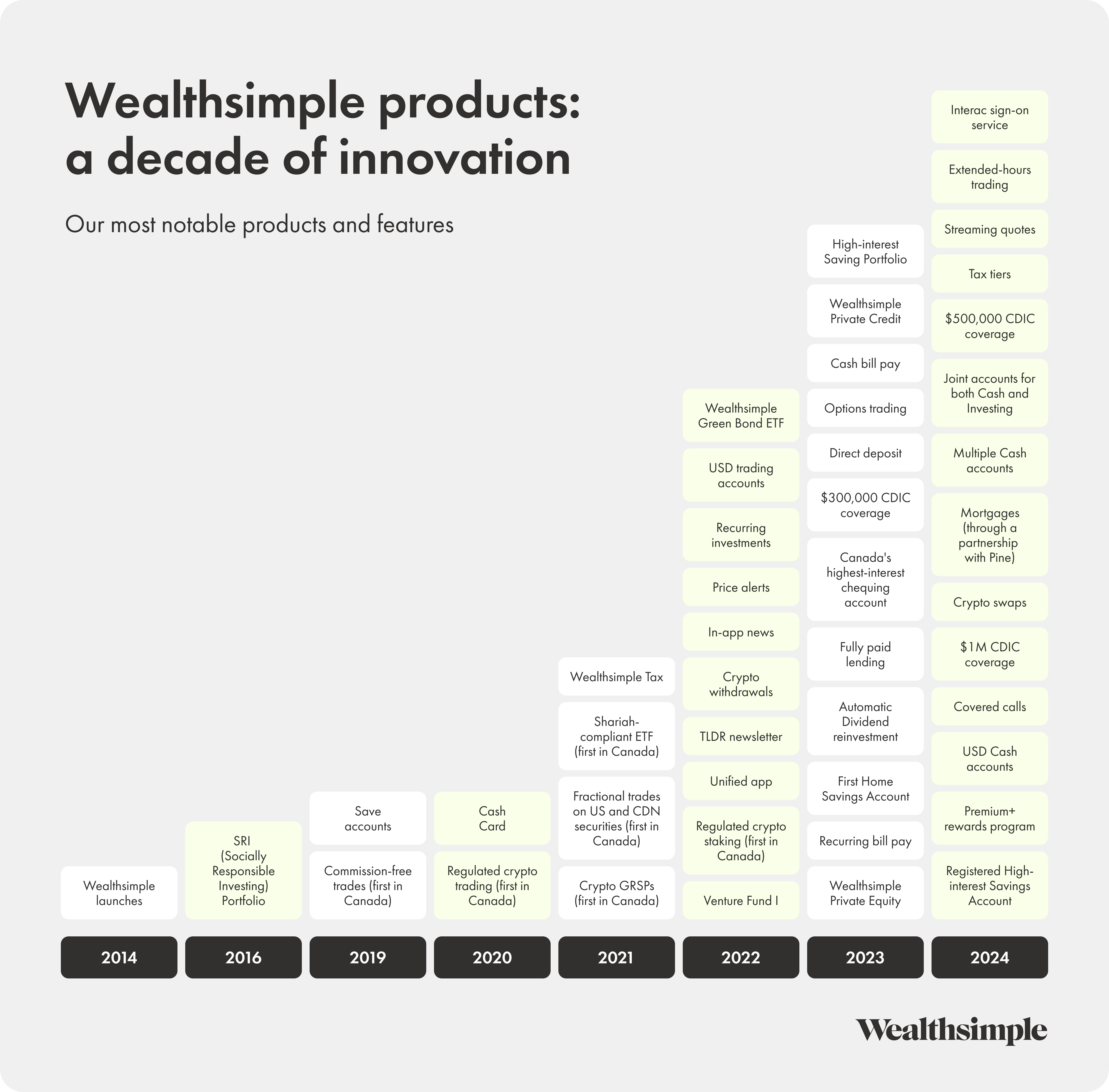

“We want to push the boundaries of what’s possible in personal finance, delivering delightful experiences and empowering our clients to achieve their financial goals and live the lives they want,” said Brett Huneycutt, Chief Product Officer at Wealthsimple. “We’re building something better than a bank. Over the past 10 years we’ve grown into a sophisticated platform that offers a full suite of financial services – from investing and trading stocks to everyday spending and filing taxes.”

Now more than ever, Canadians are seeking more sophisticated investment products as well as smarter ways to spend and save. These client needs influenced Wealthsimple’s product roadmap in 2024. Here are some highlights:

More sophisticated investment tools

- Margin Trading waitlist: since opening the waitlist in October, there’s been strong adoption of Wealthsimple’s first lending product with over a third of waitlisted clients already using the product. Margin borrowing represents a market opportunity of $38 billion in Canada.

- Private market investing: In just two years, Wealthsimple’s alternative investing funds surpassed $500 million invested, pointing to strong demand from retail investors. Alternative investing has historically been an important part of many wealthy and institutional investors' portfolios, but unavailable to the average Canadian investor. In 2024, Wealthsimple helped democratize access by allowing investors with as little as $50,000 in assets to apply.

- Crypto swaps: Crypto markets rallied with Bitcoin hitting an all-time high of $100,000 USD. In response to Canadians’ demand for trusted, seamless access to cryptocurrency, Wealthsimple listed 10 more cryptocurrencies and introduced crypto swaps. Swaps allows investors to seamlessly exchange one cryptocurrency for another directly within the platform. This functionality simplifies the trading process by eliminating the need to convert to fiat currency as an intermediary step – cutting fees in half.

Better ways to spend and save

- High interest saving: Wealthsimple Cash remains the highest interest and most rewarding chequing account in Canada. It added a host of new features this year to enable clients to break up with their banks, including ATM fee reimbursement, paycheque automations, recurring bill payments, plus multiple and joint Cash accounts. To date, Wealthsimple has paid out over $200 million in interest to clients and expanded CDIC insurance coverage to $1 million on eligible deposits.

- Top FHSA provider for Canadians: Wealthsimple continues to be the platform of choice for Canadians looking to save for a home. Since launching the First Home Savings Account for managed and self-directed investors, Wealthsimple has consistently opened over a third of all FHSAs in Canada, even as total FHSAs in the country reaches nearly 1 million.

Looking Ahead

As Wealthsimple sets its sights on 2025, millions of Canadians will gain access to Margin trading, USD chequing accounts, bank drafts, Wealthsimple’s first credit card, more personalized advice from Wealthsimple advisors, and more. Additionally, the company will continue its work with preferred mortgage partner Pine. In less than a year, the partnership has helped thousands of clients fulfill their dream of homeownership – signalling healthy demand for an alternative, digital-first mortgage solution.

With a focus on technology and financial education, Wealthsimple is poised to continue its leadership in offering a sophisticated investment platform to make financial freedom accessible to everyone.

About Wealthsimple

Wealthsimple is one of Canada’s fastest growing and most trusted money management platforms. The company offers a full suite of simple, sophisticated financial products across managed investing, do-it-yourself trading, cryptocurrency, tax filing, spending and saving. Wealthsimple currently serves 3 million Canadians and holds over $50 billion in assets. The company was founded in 2014 by a team of financial experts and technology entrepreneurs, and is headquartered in Toronto, Canada. To learn more, visit www.wealthsimple.com.

Contact: press@wealthsimple.com